About Us

Background

London Economics Press

Tools We Use

Team Leadership

Careers

What Makes LEI Unique?

Clear, readable deliverables grounded in substantial topical and quantitative evidence

Internally developed, proprietary models for electricity price forecasting incorporating game theory, real options valuation, Monte Carlo simulation, and sophisticated statistical techniques

A balance of private sector and governmental clients, enabling LEI to effectively advise both regarding the impact of regulatory initiatives on private investment and the extent of possible regulatory responses to individual firm actions

The ability to estimate relative efficiency levels and efficiency frontiers, as well as expertise to advise on network tariffs and design rates under performance-based ratemaking

Worldwide experience backed by a multilingual and multicultural staff

Background

Off-the-shelf forecasts from London Economics Press

Using internally developed, proprietary models for contract and physical asset valuation, LEI has supported clients in securing financing for large-scale investments, preparing regulatory filings, and providing expert courtroom testimony. Our analytical tools include models for price forecasting incorporating game theory, real option valuation, Monte Carlo tools, and sophisticated statistical analysis. LEI ‘s Continuous Modeling Initiative (CMI) draws on these tools, as well as the latest market data, to provide industry participants with regularly updated 10-year forecasts of key electricity markets, which are available through London Economics Press.

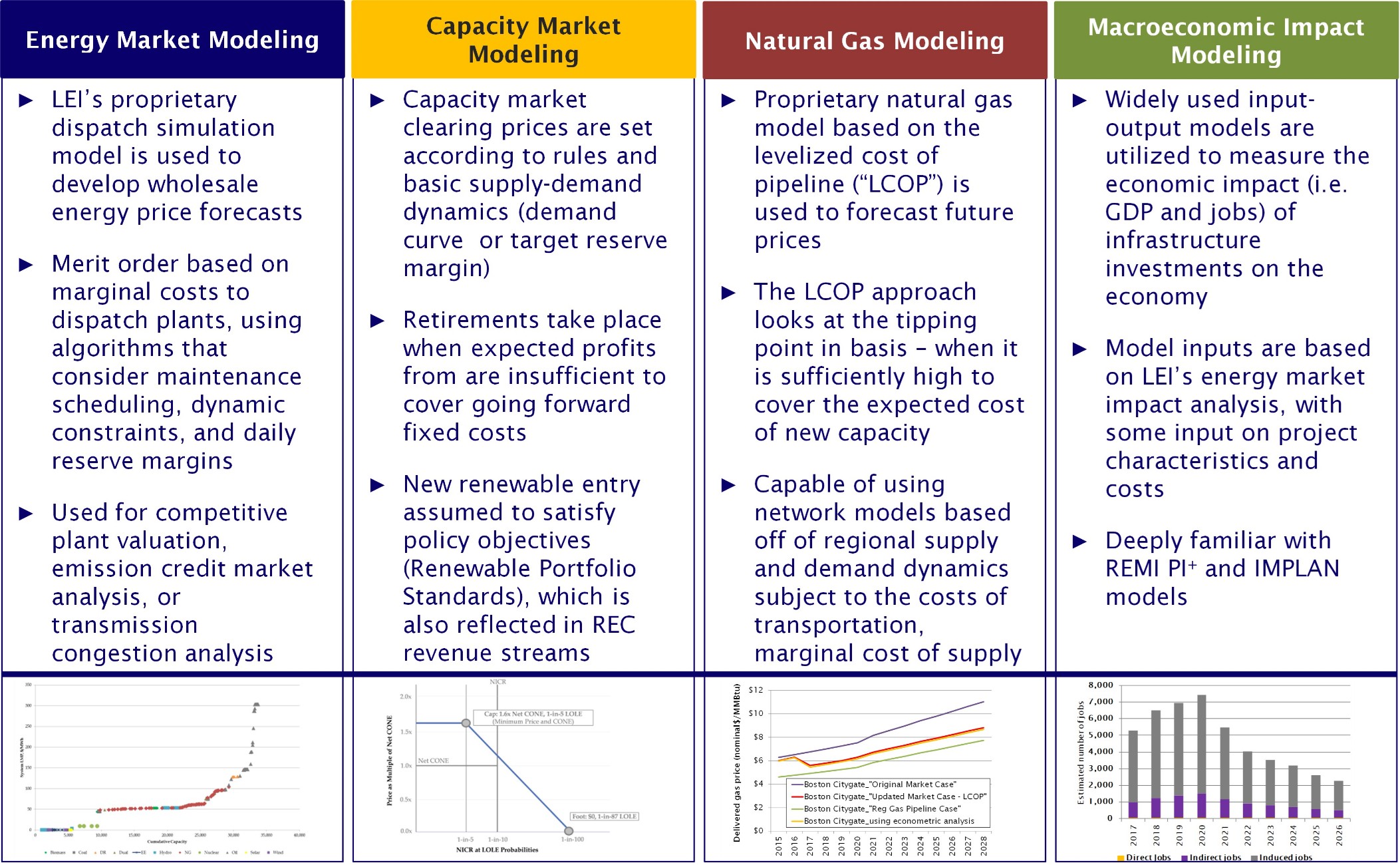

Tools We Use

- POOLMod, our proprietary pool simulation model

- CUSTOMBid, a game theoretic framework that analyzes strategic bidding behavior

- Real options valuation techniques

- Monte Carlo scenario analysis

POOLMod has been constantly upgraded over two decades of use, and it has been applied worldwide to provide a highly flexible foundation for a range of modeling activities.

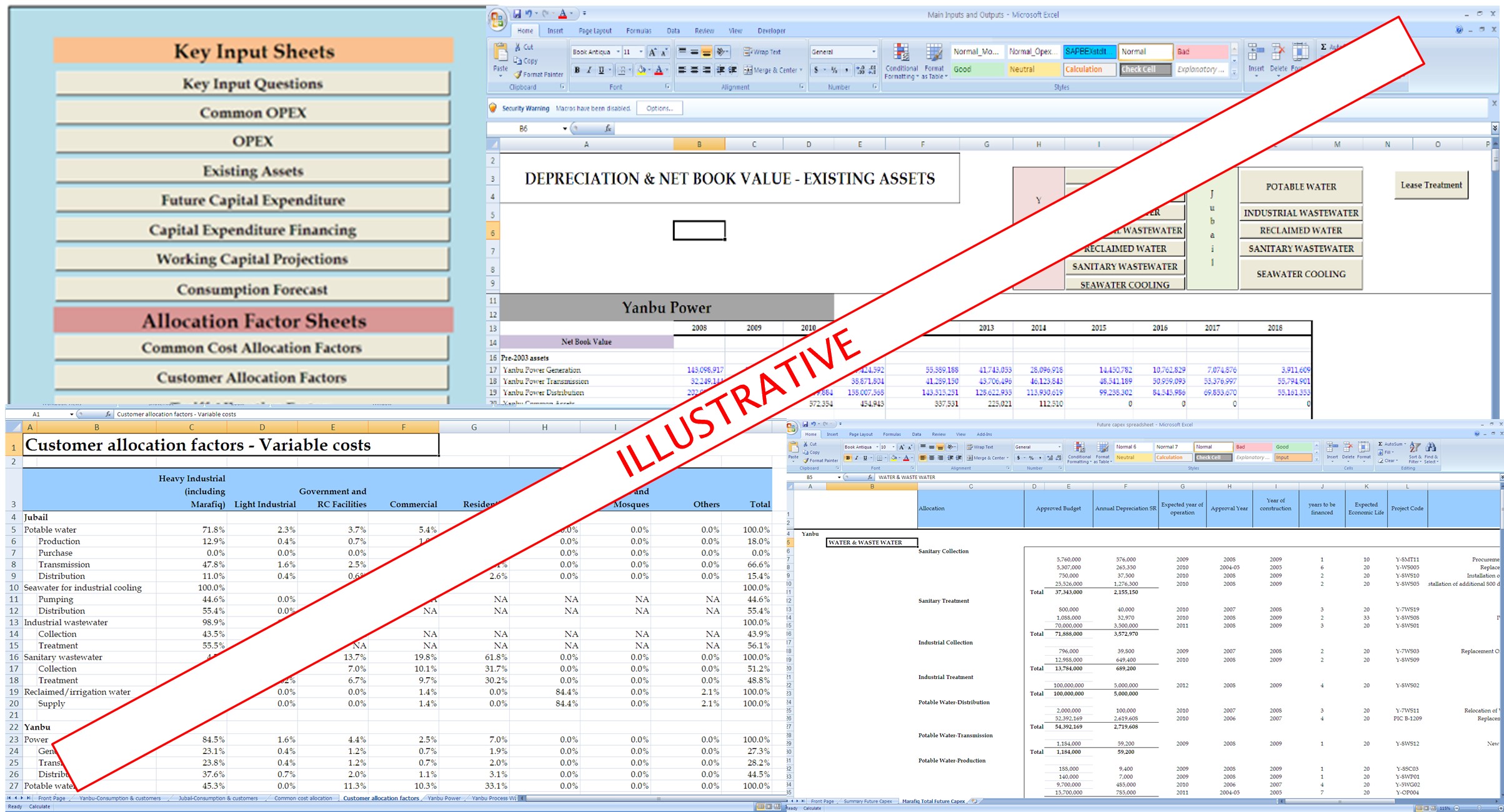

LEI has created comprehensive tariff models based on the principle of full cost recovery for many clients in the electricity and water sectors. These tariff models are grounded in regulatory economic principles and global best practices. We’ve also drafted working papers reviewing the mechanics and principles of rate/tariff setting, and developed quantitative tariff models that account for differences between distinct business units (e.g. electricity, water, and wastewater business lines).

Furthermore, LEI has developed user-friendly manuals to accompany the tariff models, which provide clear guidelines on how to use and navigate the models, assumptions utilized for the end-user tariff calculations, locations of key inputs and assumptions, and directions on how to find the main outputs. The manuals also show how revenue requirements are built up for each business line.

In addition to our Tariff modeling services, LEI has also proposed tariff filing processes, and filed tariff petitions with applicable regulatory authorities for approval.

LEI has developed a revenue optimization modeling tool (“STORM”) for merchant battery energy storage systems (“BESS”) that provides rigorous technical support for evaluating the economics of energy storage projects. STORM works in tandem with POOLMod and supports the assessment of revenues from various market products (energy and ancillary markets). The model focuses on the individual energy storage system and thus provides results specific to the specific operating unit. Charging and discharging patterns for individual battery units are usually unoptimized, under-representing how much a battery can likely earn over its life span. STORM accounts for this behavior by optimizing the performance of the storage across multiple energy products under a set of physical and operational constraints.

LEI professionals have applied sophisticated third-party models to estimate macroeconomic impacts of investments, rate changes, and environmental events. Models used include:

- IMPLAN –The IMPLAN model is a static input-output (I/O) model of the economy. Any change in one part of the economy can be used to estimate the economic impact on other sectors using multipliers that describe the relationships between industries. The model can capture direct, indirect, and induced effects of change to industrial activity such as the construction of a transmission line or closure of a pipeline. IMPLAN includes impacts on federal, state, and local taxes.

- REMI PI+ – The REMI PI+ model is a computable general equilibrium model. The REMI model adds a layer of econometric modeling onto the underlying I/O relationships. It has dynamic feedback loops built into it, which allow it to make projections into the future. This means it is useful for evaluating events that would likely change market dynamics and/or consumer behavior. The REMI PI+ model is used by government agencies, consulting firms, nonprofit institutions, universities, and public utilities.

Team Leadership

Senior Partners

A.J. Goulding

In his role as president of London Economics International, LLC, A.J. Goulding manages a growing international consulting firm focused on finance, economic, and strategic consulting to the energy and infrastructure industries. In addition to serving as a sector expert in electricity and gas markets, his responsibilities include project management, marketing, budget and financial control, and recruiting. A.J. also serves as an adjunct associate professor at Columbia University, where he teaches a course on electricity market design and regulatory economics while also supervising graduate workshops.

A.J.’s diverse background enables him to work effectively in both emerging markets and OECD countries. In North America, A.J. has been articulate in describing market relationships between wholesale power marketers, merchant plants, aggregators, and the existing investor-owned utilities. In emerging markets, A.J. has considerable experience dealing with the challenges of mixed private and public ownership, difficulties in creating credit-worthy distribution and retail entities, and the realities of line losses, unreliable fuel deliveries, and politicized labor relations. A.J. has worked on every continent except the Antarctic.

A.J. began his career performing natural gas market analysis in Washington, DC. Later, he lived for two years in New Delhi, India, where he advised the United States Agency for International Development (USAID) on electric power sector restructuring in India. He continued his work in India while pursuing his MA at Columbia University, leading to the publication of an article on Indian privatization. Simultaneously, he researched the process of power sector reform in Pakistan, contrasting it with the Indian experience. Upon completion of his MA, A.J. served as business development associate for Citizens Power, LLC, then a top 10 US wholesale power marketer. He then moved to LEI, where he has held roles of progressively increasing responsibility.

Julia Frayer

Julia Frayer is a Managing Director specializing in economic analysis and evaluation of infrastructure assets, such as power plants, natural gas-related infrastructure, electricity transmission and distribution systems, and utilities, as well as market design and expert economic advisory services for power markets. She has worked extensively in the US, Canada, Europe, and Asia in valuing electricity generation and wires assets, water and wastewater networks, as well as gas transportation assets, and in advising on market rules, innovative rate design, and institutional best practices.

Julia manages LEI’s quantitative financial and business practice area, and also specializes in market and organizational design issues related to electricity. In addition to electric generation sector market power and antitrust analysis, sample projects include:

Cost of capital estimation

- Rate-setting analysis

- Short- and long-term forecasting of wholesale power prices

- Valuation of generators and vertically integrated utilities

- Assessment of retail market design including provider of last resort portfolios and contracts

- Advice on and design of energy sales agreements

- Advisory on structuring requests for proposals and sale processes for energy assets and derivative contracts

As part of these analyses, Julia and the LEI team of economists and consultants have developed and applied proprietary real options based valuation tools, portfolio risk analytics, models of strategic bidding behavior, and sophisticated power system simulation tools, as well as customized econometric models. Julia also leads many of the firm’s regulatory economics projects, spanning such diverse issues as cost-benefit analysis, market power mitigation, tariff ratemaking, auction design (including competitive solicitations for procurement), wholesale market rules design, productivity analysis, and efficiency benchmarking.

Prior to joining LEI, Julia was working as an investment banker with Merrill Lynch in New York.

Chief Economist

Marie Fagan

Marie leads LEI’s engagements related to natural gas market analysis. She directs gas pipeline modeling efforts based on a sophisticated network model, supporting outlooks for natural gas prices and basis, and analysis of flows on North American interstate pipelines. She provides in-depth expert testimony on issues such as basis differentials, pipeline capacity and utilization in key regions, and LNG import and export supply and demand. Recent projects for LEI have included serving as independent market expert for the Maine Public Utilities Commission, in the evaluation of the costs and benefits of new natural gas pipelines into New England, which included reviewing pipeline precedent agreements and negotiated rate agreements, and leading quantitative analysis of costs and benefits; for a private investor, she evaluated contracts for firm gas transportation capacity for gas-fired plants in PJM and ISO-New England.

Marie directs LEI’s research of the Electric Reliability Council of Texas (ERCOT) electric power market. Recent projects have included assessing the current ancillary services (CAS) market and proposed Future Ancillary Services Nodal Protocol Revision Request (FAS-NPRR) in ERCOT; examination of the political, legislative, and economic drivers that led to creation of ERCOT’s Competitive Renewable Energy Zones (CREZ) and assessment of the potential for state-level support for further expansion of CREZ transmission lines; and assessment of and outlook for ERCOT’s and the Public Utility Commission of Texas’s views of the “system cost” of wind.

Marie draws on her long-time experience across fuels and regions to ensure clients benefit from an integrated understanding of market rules and practices. Recent projects have included providing expertise related to FERC practices around monitoring, enforcement, and prosecution of potential market manipulation; providing analysis of market rules and regulatory risks to support a client’s compliance program; and SWOT analysis of the economic and regulatory environment for the power sector in a Canadian province. Marie is experienced in the use of scenario analysis, an approach that helps clients identify potential turning points and arrive at decisions that are more robust given the uncertainties inherent in any future set of market conditions.

From 1996 to 2014, Marie was with Cambridge Energy Research Associates (CERA, now part of IHS, Inc.). She served as an Associate, then Associate Director for CERA’s Global Oil research practice, as Director for the North American Gas research practice; she founded the CERAView Institutional Investor Service and co-founded CERA’s Global Steam Coal service; she served as Senior Director for CERA’s North American Electric Power service and of IHS CERA’s Upstream Strategy service. Before joining CERA, Marie served as an economist with the United States Energy Information Administration (EIA), conducting analysis and modeling supporting the Annual Energy Outlook (AEO), and conducting analysis of energy company financial performance.

Marie is the author of original research with publications in academic and industry journals. She holds a PhD in Economics from the American University in Washington, DC.

Directors and Managing Consultants

Amit Pinjani

Amit Pinjani has extensive experience advising North American and international clients on matters related to electricity regulation, market design, cost of capital, and transaction advisory services. Amit has been qualified as an expert economist by multiple regulatory authorities in North America, where he has submitted expert written and oral testimony. In addition to working on several economic and regulatory advisory projects, Amit has successfully managed energy litigation support and asset valuation projects with LEI.

Internationally, Amit has managed extensive engagements with government entities and private clients in the Middle East and Asia. Amit is a seasoned project director who ensures client deliverables entail robust analysis and clear recommendations (where necessary), along with providing seamless client communication and management. Prior to LEI, he worked for the Investment Banking Division at Citibank, and assisted on capital market and mergers and acquisition (M&A) transactions.

Amit recently (in 2021) completed his master’s degree in Energy and Infrastructure Law from Osgoode Hall Law School in Toronto. This combined with his work experience allows him to provide a unique perspective to clients on energy and law matters, such as review of contracts, litigation support projects, among other relevant matters.

Cherrylin Trinidad

Cherrylin (“Len”) is a Director at London Economics International LLC. Having been with the firm for almost 15 years, Len has managed complex, high-profile and multi-million projects throughout the US as well as abroad. She has worked extensively in the areas of regulatory economics, energy market design, and mergers and acquisitions.

Len has expertise with performance-based regulation (“PBR”), having worked with utilities in North America and Southeast Asia in developing, drafting, and presenting PBR plans to regulatory authorities. She has led numerous case studies on PBR around the world and is notably very familiar with ratemaking development in Alberta (Canada), Hawaii, Connecticut, Peninsular Malaysia, Massachusetts, Minnesota, Ontario (Canada), Washington, and the UK, to name a few.

With years of experience serving as a market advisor (for both sell and buy-side) and managing various due diligence analyses in both the generation and transmission sectors, Len has worked in both deregulated and reguated market jurisdictions.

Furthermore, Len has deep expertise in the PJM Interconnection energy market- the largest electricity market in the world, having provided technical assistance to the regional transmission operator, utilities, and independent power producers in various projects touching upon the review of market rules, regulatory enhancement, development of market outlook, among others.

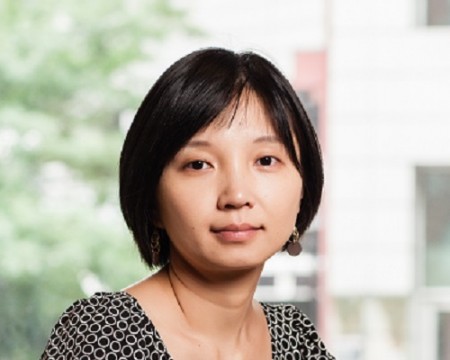

Eva Wang

Eva joined the firm all the way back in 1999. She has worked on a variety of engagements ranging from wholesale market design and generation asset valuation, to industry and market analysis and research for numerous clients in North America and Asia. Eva is involved in many of the firm’s market design engagements, spanning such diverse issues as cost-benefit analysis, market power mitigation, tariff ratemaking, auction design (including competitive solicitations for procurement), and wholesale market rules design.

Eva is also the primary modeler for many of the firm’s price forecasting engagements. She provides analysis of market dynamics and potential revenues for the purposes of valuing electric generation assets. Prior to joining London Economics International, Eva completed her Master’s degree in public policy at Columbia University.

Gabriel Roumy

Gabriel Roumy is a Managing Consultant at London Economics International with extensive experience leading complex projects and deep knowledge of the energy sector, including wholesale markets and regulatory frameworks in both North American and international jurisdictions.

Gabriel is LEI’s lead expert and modeler for the New York power markets and manages engagements on a variety of topics touching upon all aspects of the power sector value chain. Throughout his career, Gabriel has worked with and advised legislators, regulators, buy-side and sell-side financial clients, system operators, asset owners, and project developers. He has notably led numerous engagements involving quantitative analyses, wholesale power market modeling, incentive-based ratemaking frameworks, or advising energy regulators.

Gabriel has an engineering background, with experience working as a research engineer, wholesale market specialist, and business development professional for a large utility.

Sayad Moudachirou

Sayad is a senior energy sector advisor at London Economics International LLC (LEI) with more than a decade of experience working on all matters related to energy infrastructure around the globe. Mr. Moudachirou leverages his expertise in energy regulatory economics to educate market participants on market fundamentals and provide technical assistance and thoughtful insights in their operations, strategy and decision-making process. Sayad assists a wide range of clients including state agencies and other public entities, electric utilities, private developers, investment companies and large infrastructure firms.

Sayad’s expertise in the power sector involves proficiency in conducting regulatory gap analysis, designing energy policies, carrying out due diligence on commercial transactions, and strategic planning for energy transition and decarbonization roadmap. Sayad is leading several of LEI’s international engagements in Africa, Latin American, the Caribbean, and the Pacific Islands Countries and Territories. Most of his work in emerging countries revolves around improving market governance, enhancing access to affordable energy, and building resilience in the face of climate change.

Concurrently to providing advisory services, Sayad has been carrying out exclusive management services activities for an owner and operator of renewable projects in the Northeast of the US. His responsibilities entail improving operational and financial performance of a portfolio of hydropower projects, overseeing outages and re-commissioning projects, carrying out license activities, and administration of other regulatory affairs.

Prior to re-joining LEI a few years ago, Sayad worked for Wheelabrator Technologies as a finance manager responsible for budgeting, strategic planning and project management at both project and corporate levels. Wheelabrator Technologies is a waste to electricity technology company.

Originally from Benin, Sayad is a native French speaker who has lived and worked in several countries across the world. Sayad holds a Masters of Arts in Economics and Finance from Brandeis University – International Business School, a Master in Finance and Banking (Magistere Banque Finance, Assurance) from Universite Paris IX Dauphine, and a Bachelor degree in economics from Paris I, La Sorbonne.

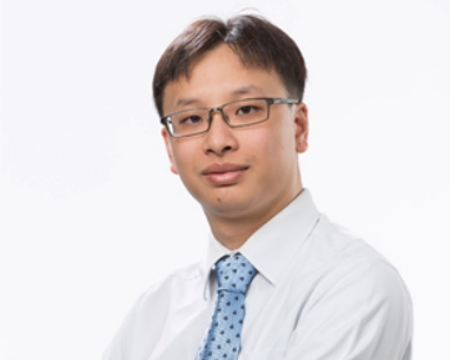

Victor Chung

Victor has over 15 years of experience assisting both private and public clients on a variety of issues pertaining to the power and natural gas industries. He utilizes critical thinking rooted in innovative modeling and fundamental analysis to deliver solutions that are tailored to clients’ needs.

Victor is based out of Hong Kong where he leads most of LEI‘s projects in the Asia-Pacific region. He specializes in issues related to the integration of clean technologies in power markets, strategic planning, and market transformation. With a unique skill set combining reliable power expertise with a detailed understanding of advanced technologies, Victor has been a key contributor to LEI’s development of cutting-edge solutions that focus on solving our clients’ problems with ever-evolving critical thinking. Prior to his employment at LEI, Victor completed his Master’s degree at Columbia University, and worked as an operations analyst for Goldman Sachs, where he advised on numerous transactions in the natural resources and energy sector.

Careers

Mission Statement

Composition of Staff

General Requirements

To Apply

Please submit a CV and writing sample to careers@londoneconomics.com